While fixed deposits are very popular in India, an increasing number of people, especially young working professionals now prefer debt funds over this traditional instrument. Read this post to know how you can select between the two.

Fixed deposits offered by banks are very popular in India. The safety and fixed returns provided by them are two of the most important reasons for their popularity. But due to excessive liquidity because of demonetization and falling interest rate, many banks have reduced their FD rates considerably.

This has encouraged a lot of investors to look for other similar options. Debt funds, especially short-term funds, are getting increasingly popular among such investors. If you are finding it difficult to select between the two, we’ve analysed them on many important factors to make the selection easier.

- Capital Protection

Fixed deposits are the safest investment instrument. FDs of up to Rs. 1 lakh are guaranteed by the RBI in case if the bank fails for some reason. So, while the interest rate for FD might vary between banks, you are almost guaranteed to receive your capital in full.

However, there is no such guarantee with debt funds. While the AMCs try to invest your money in the safest of bonds and debentures, your capital is not protected with debt funds.

- Returns on the Investment

With fixed deposits, the return on your investment is fixed throughout the tenure. For instance, if you open a fixed deposit for 1 year at 7% p.a., the interest rate would remain the same throughout the period even if the bank changes the interest rate for new FDs.

With debt funds, the returns are not fixed as the fund generates income from multiple underlying securities. While the returns are mostly higher than FDs, they are not guaranteed in any way.

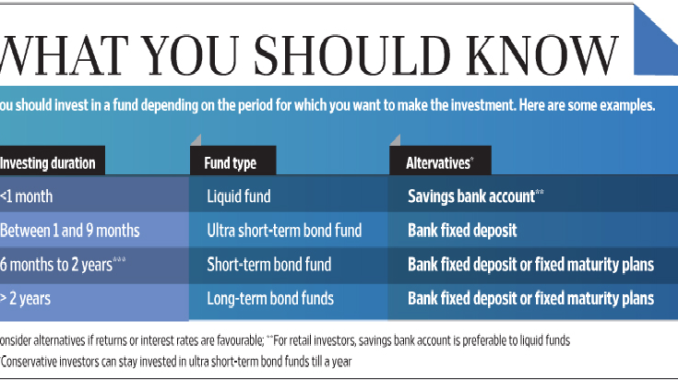

- Investment Tenure

Fixed deposits are now available in India for many different tenures. Most people prefer investing in FDs for at least a year. If you want to withdraw the FD before the tenure, you’ll receive your principal as well as interest that you’ve earned until the date of the withdrawal. However, you’ll also be required to pay a penalty for withdrawing your FD prematurely.

Many of the debt funds of short-term do not have any lock-in period, and you can invest and withdraw money from them any time. Some of the funds do not even have any exit load or penalty for premature withdrawal.

- Investment Cost

There are generally no costs involved in opening a bank FD. Moreover, the banks do not charge any fee for maintaining the FD.

Debt funds, on the other hand, involve some charges like expense ratio and transaction charges. However, SEBI has now placed a cap on 2.25% p.a. on these recurring charges for mutual funds.

- Tax Treatment

The returns that you earn from fixed deposits are added to your income and taxed as per your income tax slab.

With short term debt fund, the taxation depends on the period for which you remain invested in the fund. If you redeem your units within one year, it’ll be considered as short-term gains and taxed as per your income tax rate slab. If you hold the investment for more than one year, then it’d be long-term gains which would be taxed at 20% along with the indexation benefits.

As you can see, both the FDs and debt funds have their own benefits. So, ultimately the decision lies on what you are aiming for with your investment. Your risk appetite, objective, and investment tenure are some factors that can make it easier for you to select between the two.

Leave a Reply

You must be logged in to post a comment.