Debt relief is a strategy for debt repayment where you can negotiate with creditors to accept a part of the outstanding debt you owe and waiver the rest of the amount. In case the creditor does agree, you pay that percentage of the debt, and the remaining balance stands canceled.

Small business debt relief and top reasons for you to choose it

If you are a small business owner and have debts that you are struggling with, you can contact companies specializing in debt relief for small businesses. They will offer you an option for small business debt relief. In this way, you can avoid bankruptcy and winding up your business.

Keep bankruptcy at bay with the right company

This is, of course, the most important reason for you to opt for debt relief. Most people like to opt for debt settlement to avert bankruptcy. It is a solution for debt that stays with you for years. In fact, in the future, if you need to apply for a loan, credit card, or even apply for a job, the authorities will ask you whether you have filed for bankruptcy in the past.

In case you deny, and they find out, you will be guilty of fraud. If you are employed, you will lose your job. This is why you must settle debts with the creditors and do it in the right manner. This helps you to avoid bankruptcy and to deal with its adverse consequences.

Debt relief or debt settlement stays on your report card for some years lesser than bankruptcy. This information is never shared on public records. Once the time expires, you do not have to deal with the debt settlement ever.

Get relief from debts that overwhelm you

The major objective of debt relief is to enter into a settlement with your creditors. You give them a portion of the debt you owe. Experts in debt relief say that when operating a small business and owning a cre

There is no point in spending mindlessly with the intention of settling it all in the future. It does not work like this. You will land up in a huge mountain of debt that you will struggle hard to repay. This is where you face the threats of going bankrupt.

Read more: Four Essential Fire Safety Tips for High Street Retailers

When you enroll in a debt settlement program, you can repay your debts in a short time. It is a 100% legitimate process recommended for small business owners who face trouble repaying back their debts. Some companies offer you the benefits of credit counseling as well. You can contact them to find the best program for your needs.

Small business debt relief helps you to pay off outstanding debt legitimately. Once you have negotiated and paid off your dues, you become free of debt. When it comes to creditors, if you file for bankruptcy, they will not get much. In fact, they often get nothing. This is why they agree to debt relief settlement as it benefits them as well.

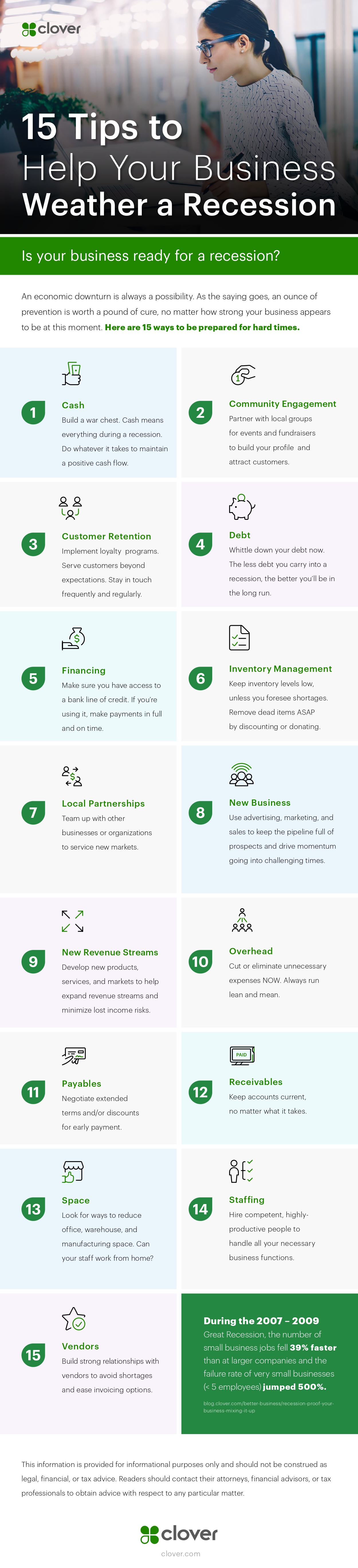

Infographic created by Clover, a payment processing company

Leave a Reply